Between market saturation, continuous employee turnover, constant battles with local, state and federal authorities, compliance regulations, losing harvests after failing those compliance regulations, and 280e, it’s hard out here for a cannabis business.

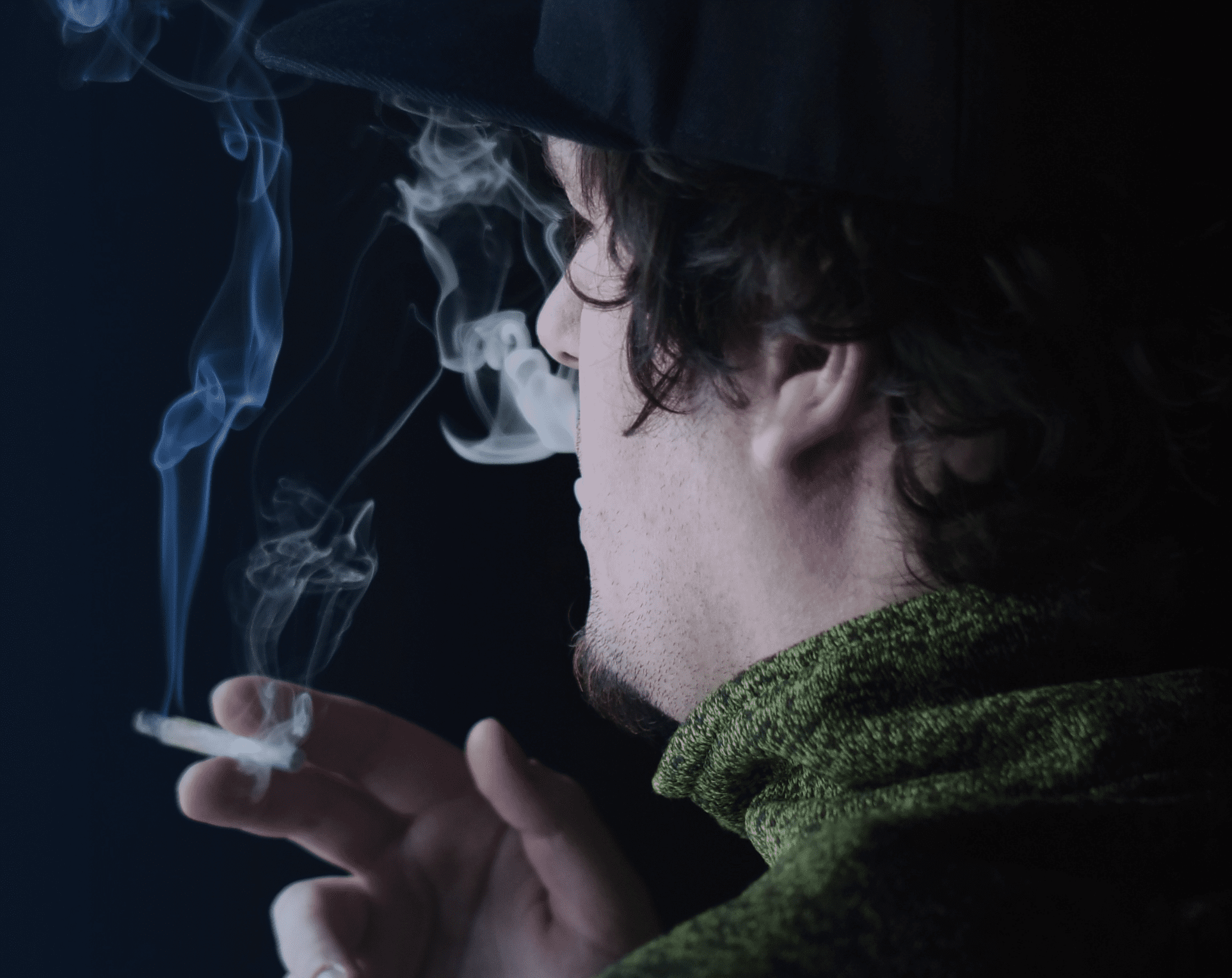

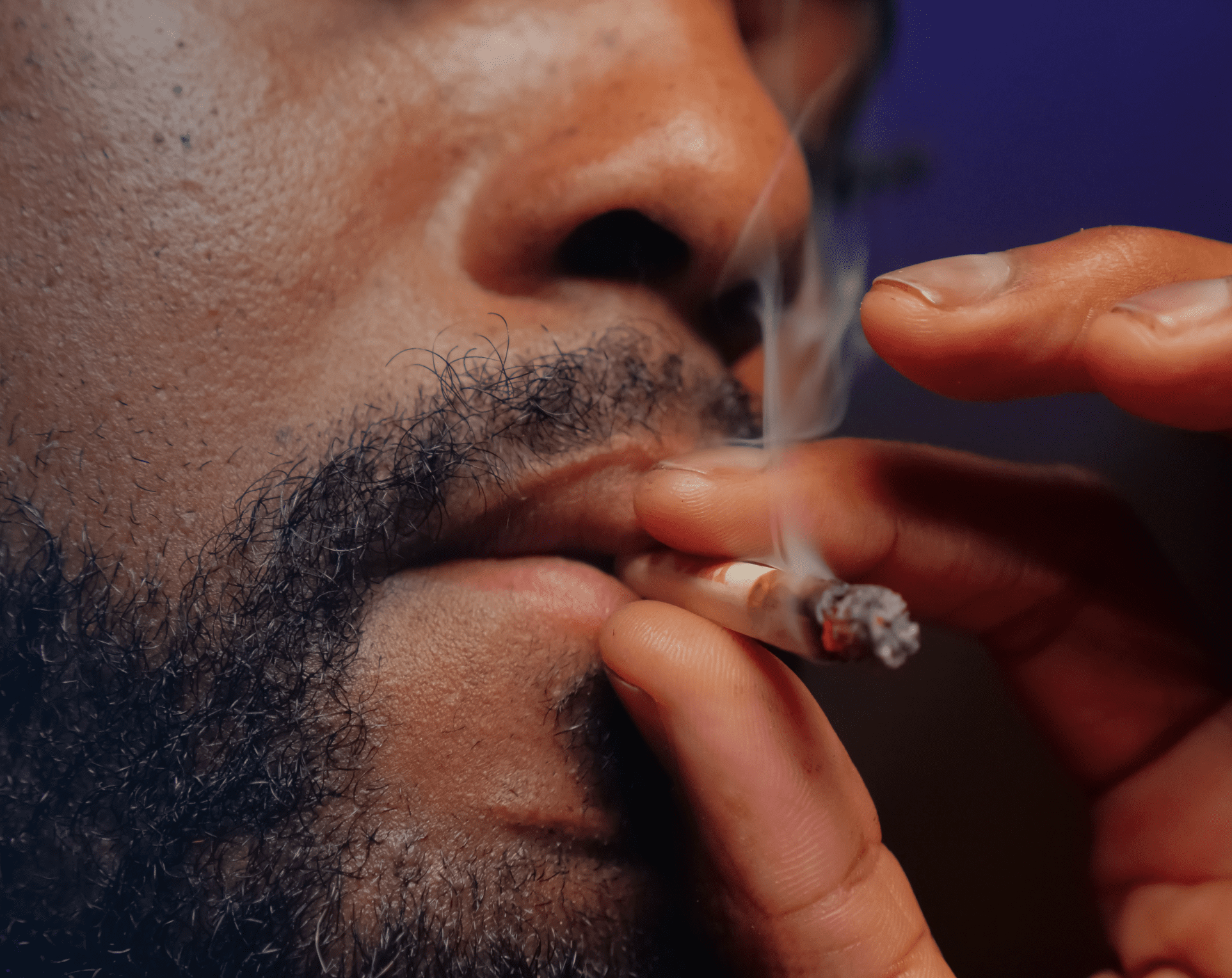

But you’re still here, day in and day out, because you’re passionate, and you want to share your passion with an increasingly curious (and increasingly desperate for a good high) world. And you want to make money.

Maybe you’ve maxed out your share of the flower market in your state. Or maybe your state’s consumers are evolving and becoming more curious about consumption methods outside of a bowl hit or a bong rip. Either way, you’re curious about a new revenue stream for your cannabis brand.

Well, have we got just the stream for you.