Our analysis identifies both positive trends and negative red flags to help you make better decisions for your brand and business.

Executive Summary

Is it just us, or does the Arizona cannabis market seem to stay mostly out of the national headlines? We don’t see stories of imminent collapse, media hype, or overblown industry personalities. It just continues to grow steadily, at its own pace. That goes for the pre-roll category as well; casually moving up and to the right. However, despite its quietness, there are some real headlines and eyebrow raisers to this market that make it unique from all others we’ve covered so far.

Q1 sales:

$36.8 million

(+2%)

Standard pre-roll sales:

$14.1 million

(+2.3%)

Infused pre-roll sales:

$22.7 million

(-2.3%)

Total brands:

75

(-7)

Total products:

1,596

(-11)

Jeeter

Stiizy

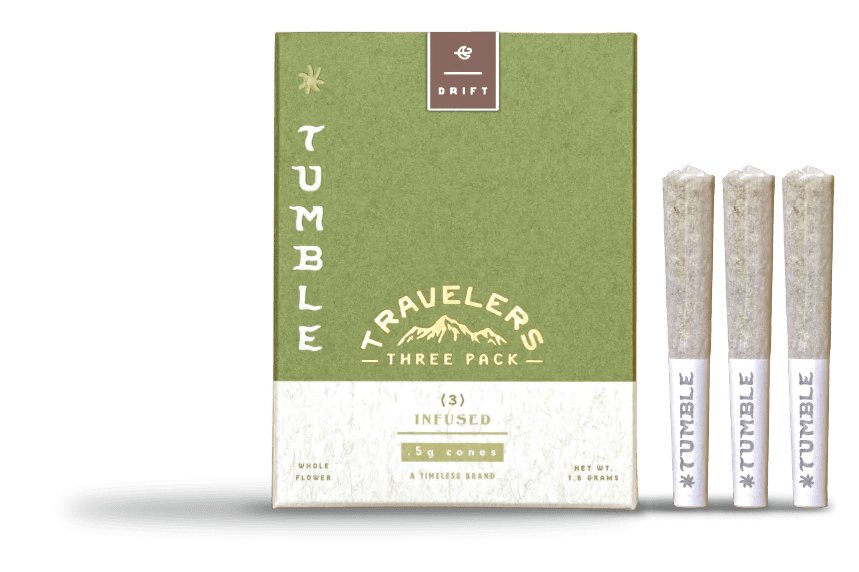

Tumble

(Timeless)

Dutchie

22 Red

Flow (Hybrid)

– Infused .5g

3-pack

Drift (Indica)

– Infused .5g

3-pack

Drift (Indica)

– Infused 1g

Flow (Hybrid)

– Infused 1g

Baby Jeeter – Barry White

– Infused .5g

3-pack

image: courtesy smoketumble.com

Who’s Smoking

TUMBLE

(Timeless Vapes)

smoketumble.com

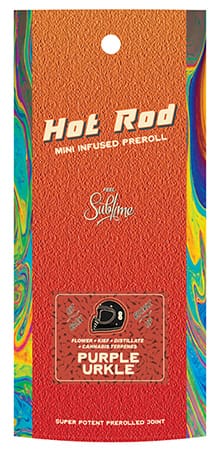

22 Red

Sublime

(Statehouse Holdings)

feelsublime.com

image: courtesy 22red.com

The Dominance of Jeeter

Jeeter is the biggest pre-roll brand in the world, but we’ve never seen dominance like this from any brand, in any market. Can they be caught? With an astonishing 33% share of the pre-roll category in Arizona, they are so far ahead of the competition that their position at the top is unlikely to change any time soon. (Second place goes to Stiizy with a 9% share.) On the product leaderboard they hold 10 of the top 20 positions (by revenue.) Their formula for budget-friendly products clearly resonates with Arizona consumers. However, vs 3PM they were at 36.8% share, so they will be interesting to watch in this market throughout 2024.

Their share is more than the next 5 brands added up.

Infused Pre-Rolls Slip?

It ain’t much, but infused pre-rolls actually dropped 2.3 points against standard pre-rolls vs P3M. With Arizona being the 6th market we’ve analyzed in our series, it is the first time we’ve ever seen the share of infused pre-rolls actually drop. It’s especially surprising considering every single one of the products in the top 20 are infused. Still, we should qualify this drop. The share of infused pre-roll revenue vs standard pre-roll revenue is 62%. That’s still the biggest share we’ve seen for infused products, with second place going to California with 60%. Despite the slip, infused is still the spot to place your bets.

image: courtesy smoketumble.com

Pre-Roll Consumption Grows… Reluctantly

More people in Arizona are smoking pre-rolls! 50% of cannabis consumers smoked a pre-roll in the analysis period, which is up 2.4% vs P3M. However, the % of consumers that prefer pre-rolls has actually dropped 1.5 points to only 13%. This is just a more prominent example of a trend appearing in many markets: the reluctant consumer. Cannabis consumers continue to gravitate towards the convenience of pre-rolls as the other consumption methods with more hype run out of steam. But they don’t really like pre-rolls. It’s just what’s easy, and in many cases, economical. Want to blow their minds? Give them a joint that’s high-quality, convenient, and economical. (Talk to us about that. We may know a guy.)

image: courtesy feelsublime.com

image: courtesy 22red.com

Very few brands, with more dropping out

Arizona has a very, very low number of pre-roll brands at only 75. That’s actually down by 7 brands vs P3M. In our California report we talked about a new metric on this topic: pre-roll brands per capita. Well, Arizona has the strikingly low number of .000010 brands per capita. By comparison, Michigan and Massachusetts both have .0002 brands per capita. What’s up with the brand exodus? It’s hard to say, and we don’t have enough intel to paint a solid picture. But it could be that smaller brands are giving up because the dominance of Jeeter, Stiizy, and Timeless are making it much more difficult to get a sustainable foothold.

Miscellaneous Head Scratchers

and Eyebrow Raisers

At just over 7 million people we’d expect Arizona to be posting bigger numbers in the pre-roll category. Massachusetts has a similar population size but double the category revenue.

Half-gram multipacks are dominating the board with 17 of the top 20 products being either 3 or 5 joint packs. Maybe folks in Arizona walk their dogs a lot?

There is a relatively low preference for hand-rolled joints among inhaleable cannabis consumers in Arizona. Only 10% prefer this consumption method, compared to 25% in Massachusetts and 21% in California.

image: courtesy Cannacon

Summary

The Arizona pre-roll market paints a curious picture: steady growth alongside unique trends and curiosities. While overall sales rose 2%, a closer look reveals nuances. Convenience reigns supreme, with consumers increasingly turning to pre-rolls (50% usage) despite not necessarily preferring them (13% preference). This preference for “easy” translates to the dominance of half-gram multipacks, suggesting on-the-go consumption is key.

The market itself reveals a tale of two titans and shifting competition. Jeeter reigns supreme with a whopping 33% market share, leaving rivals like Stiizy and even local hero Tumble in the dust. However, brands like 22Red and Sublime are making waves with impressive growth, showcasing strategies like premium flower and budget-friendly infused options. But this success story hides a less rosy side: smaller brands are exiting the market, unable to compete with established giants.

Further quirks abound. Compared to its population, Arizona’s pre-roll revenue lags behind similar states like Massachusetts. Additionally, hand-rolled joints hold surprisingly low appeal (10% preference) compared to other regions.

In conclusion, the Arizona pre-roll market offers a fascinating mix of steady growth and unexpected trends. Convenience is king, budget-friendly giants dominate, and smaller brands struggle. While infused pre-rolls remain popular, their growth has slowed. As the market evolves, it’ll be interesting to see if convenience continues to trump preference, if new players can find their niche, and if Arizona’s unique quirks persist.

RollPros is the manufacturer of the Blackbird, the only automated joint machine that makes joints the same way you do: rolled, not stuffed. Brands across the US and Canada use the Blackbird to create unique, value-added products that 4/5 of consumers prefer over pre-rolls made with cones. RollPros is dedicated to helping customers build successful, profitable brands through continuous innovation, exceptional customer support, and category expertise.

Want to learn more? Reach out to one of our Pros now.

Download PDF

Grab a printable copy of this report by filling out the form below: