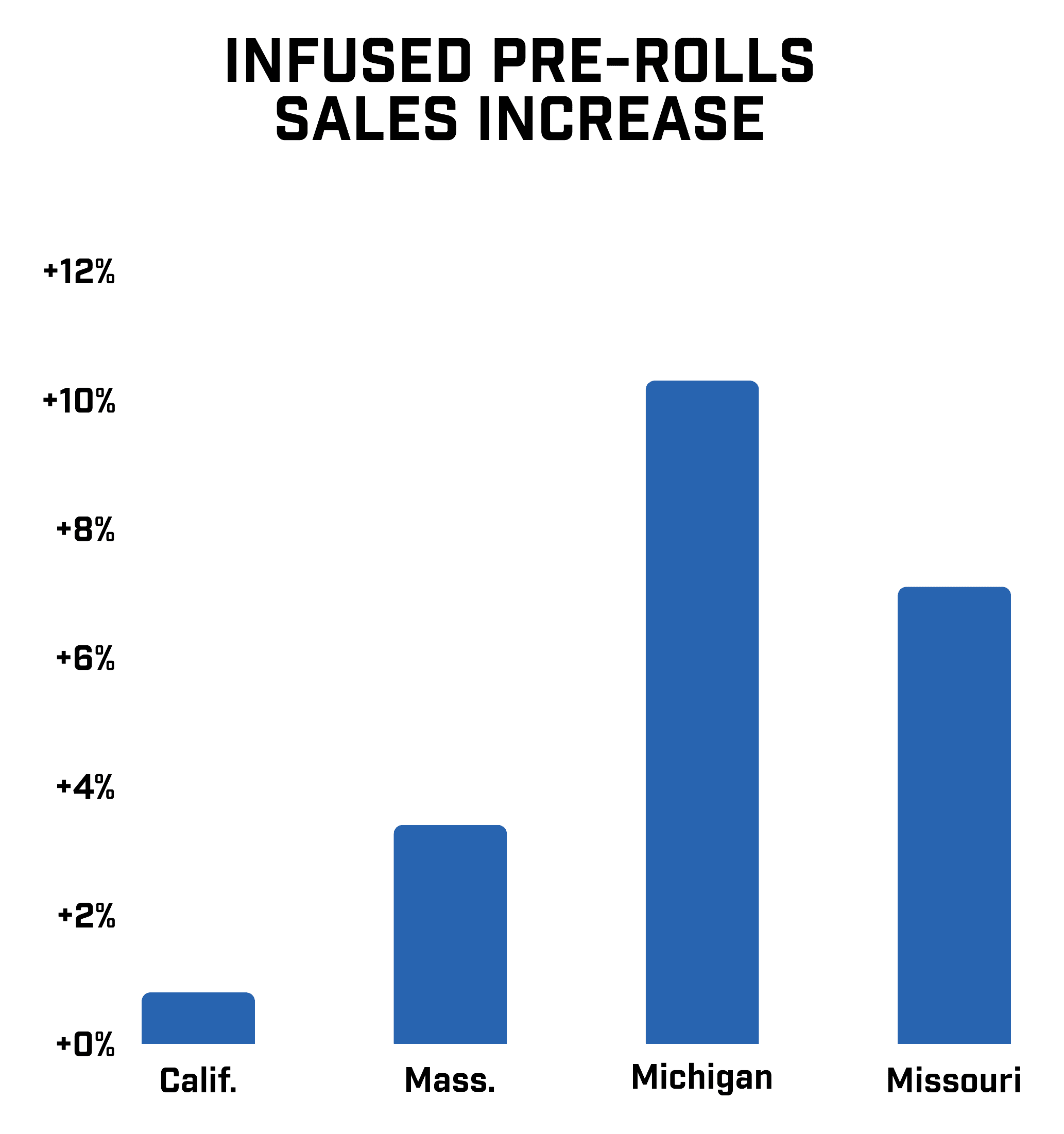

Michigan’s market is blazing, with infused pre-rolls now accounting for 40 percent of all pre-roll sales. They saw a 10.3 percent increase in infused pre-roll sales between Q4 2022 and Q1 2023 even with two pre-roll brands exiting the market during that time, leaving plenty of room for a new infused pre-roll brand or product to come in and dominate.

Missouri saw a 7.1 percent increase in infused pre-roll sales once its market opened up from just medical to medical and recreational. Of course, they were going to see a jump there no matter what since the consumer base increased. What’s important to note is that they only had seven new pre-roll brands enter the market when recreational launched. That means, like Michigan, there’s plenty of room in Missouri for a pre-roll and/or infused pre-roll brand to take the lead.

Meanwhile, Arizona’s market is a little offbeat, with infused pre-roll sales dropping 2.3 percent and non-infused pre-roll sales increasing by two percent. This could be the market leveling off, though. As it stands, even with the decrease, infused pre-roll sales hold 62 percent of the pre-roll market share in Arizona. Most of the top-selling infused pre-roll brands are multi-state operators with name recognition and money (Jeeter and Stiiizy), which could explain why seven pre-roll brands left the market during the timeframe we studied. Competition may be intense, but we’re inclined to view it as an opportunity. Consumers might not be slowly losing interest in infused pre-rolls; they could just be slowly losing interest in Jeeter and Stiiizy’s take on infused pre-rolls. If other brands can stay strong, there may be an opportunity for a new top dog in the near future.