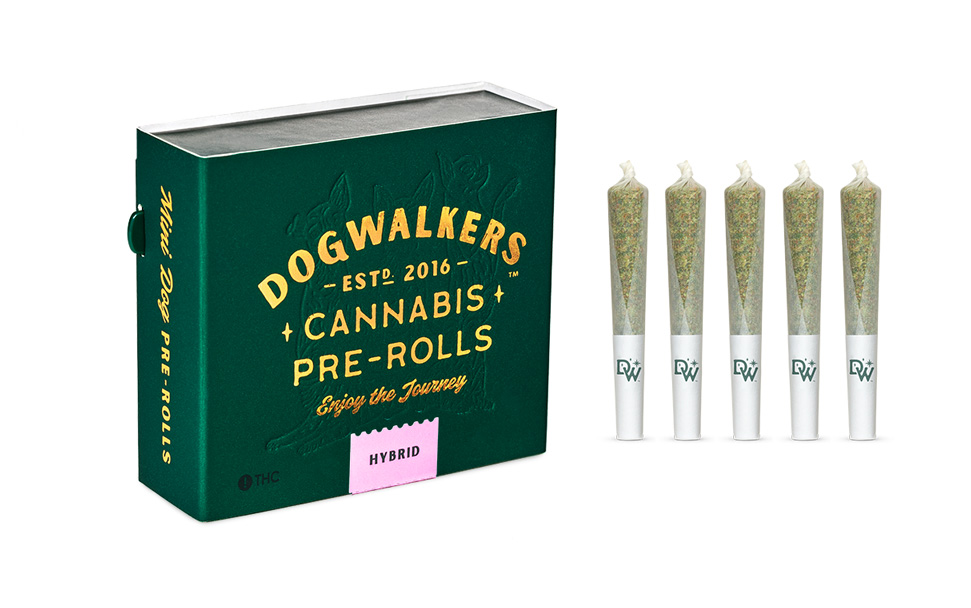

Pre rolls are hot right now. Canada sells nearly as much of them as regular flower—perhaps even more than, at this point—and the US market isn’t far from achieving the same.[1]

Future-focused operators see the value in prioritizing a pre roll product line because, unlike flower in many states, it’s a segment that’s not losing steam. A solid pre roll product can carry a cannabis brand when interest in other products might be waning.

Because of this continued interest from consumers, pre rolls are also evolving. In 2025, we’re expecting freshness to take priority (finally), smaller-sized infused joints to gain traction, and a whole lot of growth.

Let’s dig in.