Free Market Analysis

for Pre-Roll Operators

for Pre-Roll Operators

Pre-Roll Market Reports

Here you will find our catalog of state-specific Market Reports. Regardless of which state your business is in, these reports provide valuable information to help you make more informed decisions. We publish a new report approximately every two months.

If you would like to be updated next time we publish a market report, please enter your email at the bottom of the page.

California

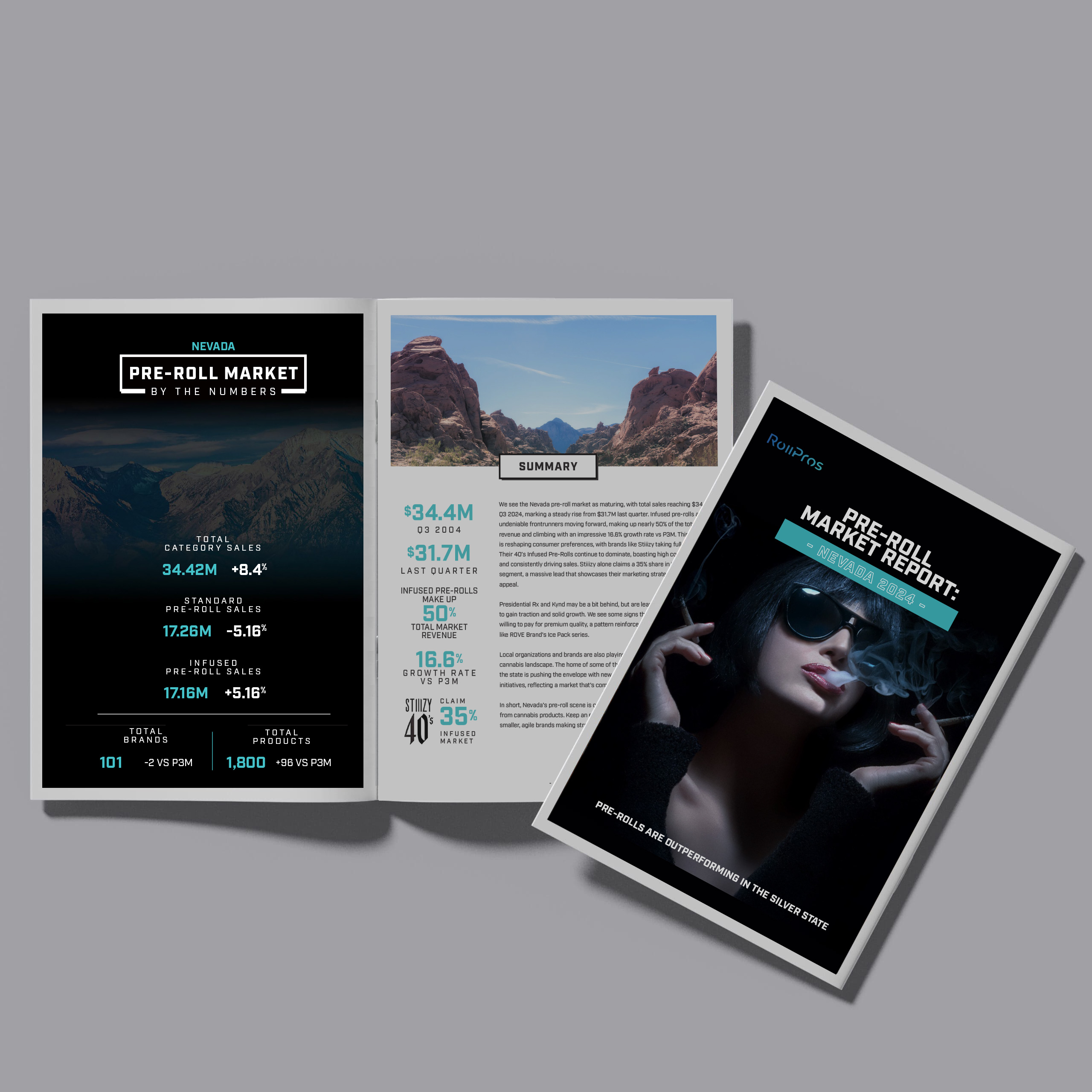

Nevada

Nevada’s pre-roll market is still outperforming, with infused products driving nearly half of all category sales and strong players like Stiiizy dominating the scene. As MJBiz descends on Vegas, it’s clear the state’s cannabis scene is all about potency, but the growing conversation around quality flower could shape future trends. Nevada is proving to be one of the most dynamic (and crowded) cannabis markets in the country. Dive into our latest report for insights, data, and what’s next in this space.

Maryland

Explore the 2025 Maryland Cannabis Market Report for key insights into one of the country’s fastest-growing adult-use markets. This report highlights emerging consumer trends, top-performing categories, and how Maryland’s unique landscape is shaping cannabis sales. Discover what’s driving demand and how brands are adapting in this dynamic and rapidly evolving market.

Colorado

Known for its early adoption and mature regulatory environment, Colorado’s market offers insights into future cannabis trends across the country. With 94 active brands in the pre-roll space, competition is driving innovation and product quality.

New Jersey

The New Jersey cannabis market had substantial growth in the last quarter of 2023. Total cannabis revenue soared by 23%, with pre-rolls specifically notching an 8% increase compared to the previous three months. Despite this, the pre-roll segment faced challenges with limited brand diversity and only 23 active brands.

Arizona

California

Massachusetts

Missouri

Michigan