PRE-ROLL MARKET REPORT

Nevada

Our analysis identifies both positive trends and red flags

to help you make better decisions for your brand and business.

Executive Summary

The Nevada cannabis market shows careful growth, with pre-rolls outperforming other categories. Total state cannabis sales rose by 4.5%, but pre-roll sales surged by 8.4%, demonstrating the category’s expanding appeal. Forecasts predict the segment could reach $164.8M by 2028, with a strong 6.7% annual growth rate.

Consumers in Nevada remain loyal to inhalable products, with a significant 59% preferring these over edibles or tinctures. Even with strong pre-roll revenue, there has been a decrease in both usage and preference for this preference though, moving towards ingestibles T3M.

Nevada’s pre-roll market stands out for its increasing focus on premium, experience-driven offerings, a trend bolstered by the state’s tourism-driven consumer base. The competition is intense, with 101 active pre-roll brands and a staggering 1,800 unique SKUs.

Nevada

pre-roll market

by the numbers

Jul-Sep 2024

Total Category Sales:

34.42M (+8.4%)

Standard pre-roll sales:

$17.26M

Infused pre-roll sales:

$17.16M

Total brands:

101

-2 vs P3M

Total products:

1,800

+96 vs P3M

Pineapple Express

Infused Pre-Roll (0.50g), 4 Pack

King Louis XIII

Infused Pre-Roll (0.50g), 4 Pack

Blue Dream

Infused Pre-Roll (0.50g), 4 Pack

Strawberry Cough

Infused Pre-Rolled (0.50g), 4 Pack

Skywalker OG

Infused Pre-Rolled (0.50g), 4 Pack

Who’s Smoking

Stiiizy

Growth Rate: +35% | Category Share: 16.9%

From flavors like Pineapple Express to King Louis XIII, Stiiizy’s focus on quality and flavor diversity is undeniable. They hold 13 of the top 20 pre-roll products, giving us signs that heavy investment in the category is worthwhile.

Beyond product offerings, Stiiizy’s sleek and recognizable branding has solidified their influence, creating a strong following among consumers. In addition to spending the time and effort on community building, they’re proactive in promoting social equity in the cannabis space, which may resonate well in diverse markets like Nevada. As they continue to expand and adapt, Stiiizy is poised to not only maintain but grow their lead in the Silver State.

Kynd (Ayr)

Growth Rate: +217.3% | Category Share: 5.8%

Holding 5.8% of Nevada’s pre-roll market, Kynd is a standout. In the trailing three months, they’ve seen a staggering 217% growth rate—the largest gain in market share compared to P3M. This explosive success underscores their focus on quality, with small but significant details like tightly controlled curing processes that preserve terpene profiles and elevate potency.

Kynd’s rise comes in the midst of stiff competition, proving that homegrown brands with a dedication to purity and old-school authenticity still wins consumers.

ROVE Brands

Growth Rate: +18.1% | Category Share: 3.5%

They command a top-tier price point, with ARP (Average Retail Price) figures pushing over $35 for a three-pack, making them some of the most expensive options on the market at around $24.50 per gram. But here’s the kicker: people are willing to pay. Their top two infused pre-rolls recorded impressive growth this quarter, with sales up 41% and 8%, solidifying ROVE’s reputation as a must-try brand in Nevada.

Infused Pre-Rolls Dominate in a Mature Market

It’s not surprising to see infused pre-rolls now represent almost half (49.9%) of the total pre-roll sales in Nevada. Taking an additional 3.48 share from standard pre-rolls T3M, 19 of the 20 top products in the pre-roll category are infused. Stiiizy continues to dominate, with products like King Louis XIII and Pineapple Express four-packs, each selling upwards of 107% more vs P3M.

Infused is often still synonymous with potency, and we see ROVE Brands has adopted a high-stakes strategy, pricing their infused pre-rolls at some of the market’s highest rates, averaging over $35 per three-pack. Even so, their Ice Pack lines, featuring popular strains like Maui Waui and Acapulco Gold, have managed growth rates of 41% and 8%, respectively.

However, there’s another side to the story. While consumers are thrilled by the high potency numbers, there’s a growing conversation about the importance of quality flower. Infused pre-rolls are great for packing a punch, but they shouldn’t compromise on the terpene-rich, flavorful experience that true connoisseurs crave. The focus on potency sometimes overshadows the nuanced profiles of the flower itself, which can detract from the overall smoking experience.

Brands that prioritize quality, ensuring their base flower is top-tier before the infusion, stand to capture an even more discerning market segment. There’s an opportunity here to elevate infused pre-rolls to offer a well-rounded, flavorful experience. As consumer awareness grows, so does the desire for a balance between strength and quality.

Stiiizy 40’s

We were going to mention the popularity of multipacks in the top pre-roll product list, but in reality, Stiiizy’s 40’s Infused Pre-Rolls are basically creating it. Their SKUs hold 13 of the top 20 slots in our list. Known for their strategic use of infused products, Stiiizy’s offerings combine flower with live resin and are rolled in kief—a formula that has proven popular among consumers seeking a potent, full-spectrum experience.

In Q3 2024, Stiiizy’s Pineapple Express 40’s topped product charts, generating over $396,000 in revenue. With an Average Retail Price (ARP) hovering around $29 for a four-pack, Stiiizy’s strategy of prioritizing premium, consistent experiences appears to be paying off, without the need to undercut competition.

WHY ARE STIIIZY’S 40’S SO POPULAR?

Market trends suggest that consumer demand for high-potency/infused pre-rolls is a significant driver. Stiiizy’s consistent product lineup, which features in-demand strains caters to this preference effectively. They’ve hit a sweet spot for consumers with a deep line of infused multipacks.

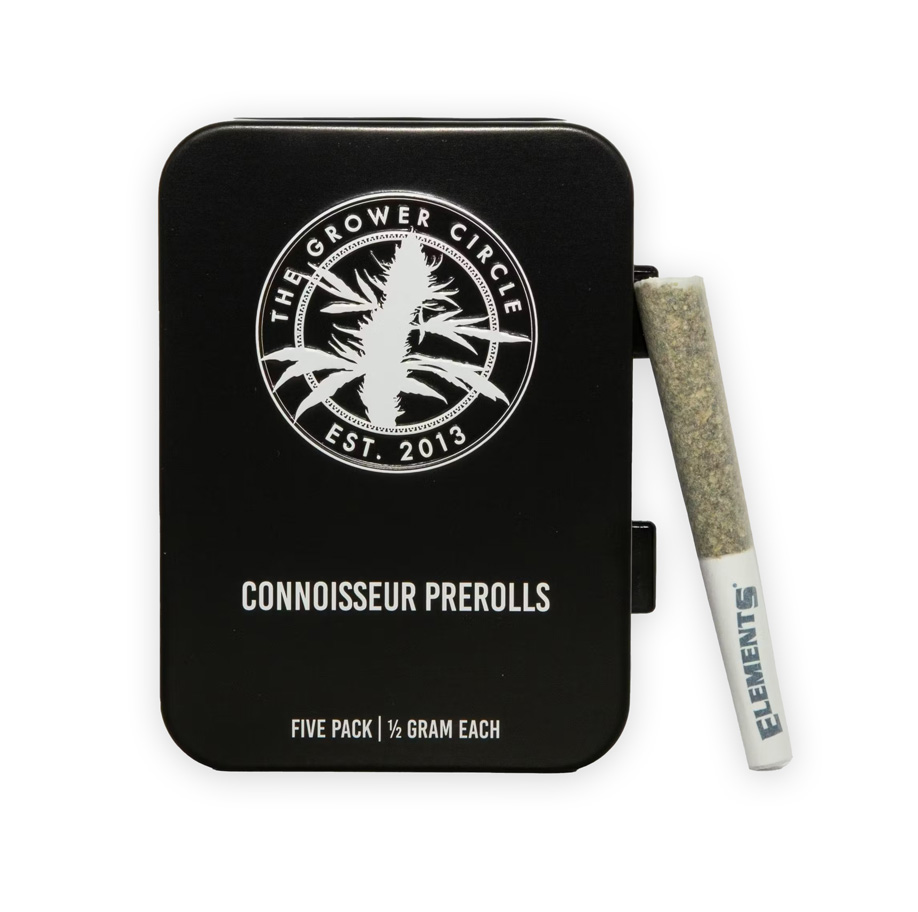

Local Brands Holding Their Own Against Giants

Despite national brands like Stiiizy dominating the market with a 35% share, local players like Kynd and The Grower Circle are still seeing growth. Kynd’s massive 217% increase in sales this quarter demonstrates that Nevada consumers may still have a strong affinity for local, homegrown companies. This trend suggests that even as the market becomes more competitive, there’s still room for local brands to carve out significant niches.

Industry Interview with Patrick Allen

We sat down with Patrick Allen, co-founder of INDO Cannabis, to gain insights into how his brand evolved from Washington to Nevada, emphasizing quality flower, infused pre-rolls, and innovative solventless infusions in a competitive market.

Can you tell us about INDO and your role in the company?

INDO started out in Washington around eight years ago. Back then, we were a small brand focused on flower and cartridges—doing things that bigger brands couldn’t. When we moved into Nevada, we brought that same mindset, but with a focus on products tailored to the local market. I co-founded the company with Matt Olsen, and today I manage our growth and quality control across the board. We’re still a relatively small team with about 20 employees, but we’ve got a clear direction, are always on the look for high performing categories, and were pretty much pioneers of Nevada’s tablet category.

What are some trends you’re seeing with Nevada consumers when it comes to pre-rolls?

There’s a real appetite for potency in Nevada, and infused pre-rolls definitely feed into that demand. Monster brands like Stiiizy and giant investments are here, so the competition is tough, especially in the infused realm. But there’s also a real group of consumers that appreciate quality over sheer THC levels. We’re finding they’re after the whole experience—aroma, flavor, and smoothness—and are gravitating toward high-quality flower. It’s a slower shift, but it’s there, and we’re excited to see how it grows. INDO Smokes, for example, come in a 10-pack format that’s drawn a fairly dedicated following. While we don’t ignore potency, we don’t really compete with it either. We just make sure the product can stand on its own in terms of quality.

How does that influence your sourcing and production strategy for Nevada?

Quality sourcing is key. We work with some of the best cultivators in Nevada—Nature’s Chemistry, Polaris, and Stackhouse, and others to ensure our flower isn’t just potent but also top-shelf. We want to offer consumers an option that speaks to quality. That’s where we see the value: giving people a complete experience in every smoke. As far as production goes, we’re pretty much banging on the walls of our current facility, so we are looking for more and more ways to increase production and create more SKUs.

Nevada’s market is competitive. What are some of the biggest challenges for brands like INDO?

It’s a crowded space, pretty much by design. Nevada sees a lot of investment and new brands coming and going all the time. For us, staying competitive means looking for the niches that aren’t fully tapped. Lower-potency products are something we’re exploring as a way to cater to consumers who don’t need high THC all the time. The key to staying relevant here is flexibility. We have to be ready to adapt quickly and keep finding ways to offer something fresh to the market.

Are there particular opportunities in Nevada you’re excited about?

Absolutely. We’re always looking to push innovation, especially in the area of pre-rolls. We’re confident they’ll remain a popular and profitable category for a while. As for the future, we’re particularly interested in grabbing more share of the tobacco market with some of our lower potency products, as well exploring more applications of rosins. Infusions are great, but most are bad since you’re smoking distillate. There’s some genius happening with solventless options right now we’d like to explore.

Summary

We see the Nevada pre-roll market as maturing, with total sales reaching $34.4M in Q3 2024, marking a steady rise from $31.7M last quarter. Infused pre-rolls are the undeniable frontrunners moving forward, making up nearly 50% of the total market revenue and climbing with an impressive 16.6% growth rate vs P3M. This demand is reshaping consumer preferences, with brands like Stiiizy taking full advantage. Their 40’s Infused Pre-Rolls continue to dominate, boasting high consumer loyalty and consistently driving sales. Stiiizy alone claims a 35% share in the infused segment, a massive lead that showcases their marketing strategy and product appeal.

Presidential Rx and Kynd may be a bit behind, but are leaning on premium offerings to gain traction and solid growth. We see some signs that Nevada’s consumers are willing to pay for premium quality, a pattern reinforced by the success of products like ROVE Brand’s Ice Pack series.

Local organizations and brands are also playing a key role in shaping Nevada’s cannabis landscape. The home of some of the biggest events like MJBiz Con, the state is pushing the envelope with new product types and community-based initiatives, reflecting a market that’s competitive yet collaborative.

In short, Nevada’s pre-roll scene is capable of redefining what consumers expect from cannabis products. Keep an eye on the big players, but don’t overlook the smaller, agile brands making strategic moves to capture market share.

RollPros is the manufacturer of the Blackbird, the only automated joint machine that makes joints the same way you do: rolled, not stuffed. Brands across the US and Canada use the Blackbird to create unique, value-added products that 4/5 of consumers prefer over pre-rolls made with cones. RollPros is dedicated to helping customers build successful, profitable brands through continuous innovation, exceptional customer support, and category expertise.

Want to learn more? Reach out to one of our Pros now.

Download PDF

Grab a printable copy of this report by filling out the form below: