Our analysis identifies both positive trends and negative red flags to help you make better decisions for your brand and business.

Overview

With our Market Report series now over two years old, we’ve had the opportunity to provide free yet detailed analysis of the pre-roll category in more than a dozen markets. To provide the most up-to-date and actionable information, the series continues with new Reports on markets we’ve already covered. Rather than a simple re-hash of the market, these “second look” reports provide an additional layer of data that allow us to compare now vs then. The original report vs the new report. This Oregon report is one of those, and wow, it’s an interesting one.

Oregon is one of the oldest recreational cannabis markets in the US, taking the plunge just barely after Colorado and Washington. But they blazed their own trail right from the beginning. With no limit on licenses and a very low barrier to entry, Oregon’s cannabis scene is a tale of boom and bust… on steroids. The boom passed fairly quickly, unfortunately, and the Oregon market completely collapsed by 2017. Thousands of tons of plant material was being diverted to other states, thousands of tons more was simply rotting in barns, and what was left was being sold at prices so low that the business model was simply unsustainable for many, maybe most growers. It remains one of the most competitive and price-compressed markets in the U.S.

Our first look at Oregon was a bit over two and a half years ago, analyzing data from the three month period of November 2022 to January 2023. (For the sake of this paper and analysis we will still call this Q4 2022, even though we are a month off.) Our new dataset includes July, August, and September of 2025. We also compare both “now” and “then” to provide so you can see how things have changed in the past several years.

And wow, the change is significant.

From Q4 2022 to Q3 2025 the overall Oregon market remained basically flat. That’s not the case for the preroll category, which posted 27% revenue growth over the same time period, ($26,517,409 vs $33,650,072)[1]. Interestingly, only 8 of the top 20 brands (ranked by revenue) from Q4 2022 show up in our Q3 2025 top 20! As one of the very few markets untouched by the large MSOs, the brands that are succeeding here are virtually all local and have had to find their own way without access to massive investments and corporate guidance.

In other words, the brands that are showing up now have figured out how to make it one of the most difficult markets in the country. If you can make it in Oregon, you can make it anywhere, so regardless of where you operate, you should take note of the good ol’ Beaver State. Now let’s get into it.

Revenue:

$33.65 Million

(+2.1%)

Infused pre-roll sales:

$12.2 Million

(+0.3%)

Standard pre-roll sales:

$21.45 million

(+0.3%)

Total Brands

180 (-6)

Total Products

3,068 (-90)

Portland Heights

Sticks

Hellavated

Benson Arbor

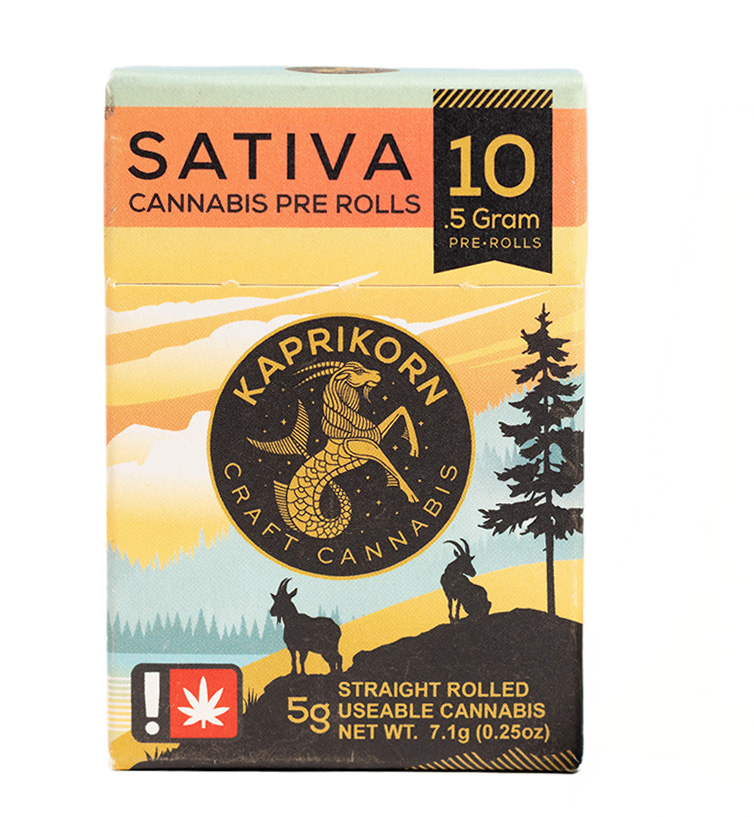

Kaprikorn

Hybrid Strain Blends – 1g 10-pack

Hybrid Strain Blends – .6g 12-pack

Hybrid Strain Blends – .5g 10-pack

Hybrid Strain Blends – 1g 10-pack

Hybrid Strain Blends – 1g 10-pack

Who’s Smoking?

Sticks

STICKS Rises to Oregon’s Top Tier

Benson Arbor

Benson Arbor’s Craft Meets Scale

Kaprikorn

From Newcomer to Contender

Massive compression of brands and products

Oregon’s pre-roll market is consolidating fast. In 2023, there were 256 brands offering 4,226 products. The latest dataset shows 180 brands with 3,068 products, reflecting a significant compression of both brands and SKUs.

Market share is also becoming more concentrated. In the 2023 data, no single brand held more than 4% market share, and only six brands surpassed 3%. Today, the top five brands each hold 4% or more, with a total of nine brands above the 3% threshold. This signals a clear shift toward dominant players commanding larger portions of the market.

Revenue separation among the top 20 brands has widened dramatically. In 2023, the gap between the #1 and #20 brands was only $662,332 ($1,084,322 vs $422,044). In 2025, that difference has grown to $2,073,700 ($2,535,875 vs $462,175). The top brands are pulling away, demonstrating that leading operators are capturing more dollars and setting themselves apart from smaller competitors.

The takeaway is clear: Oregon’s pre-roll market is no longer a flat playing field. Fewer brands are controlling more of the market, and the top performers are increasingly distinguishing themselves through distribution, product quality, and brand recognition.

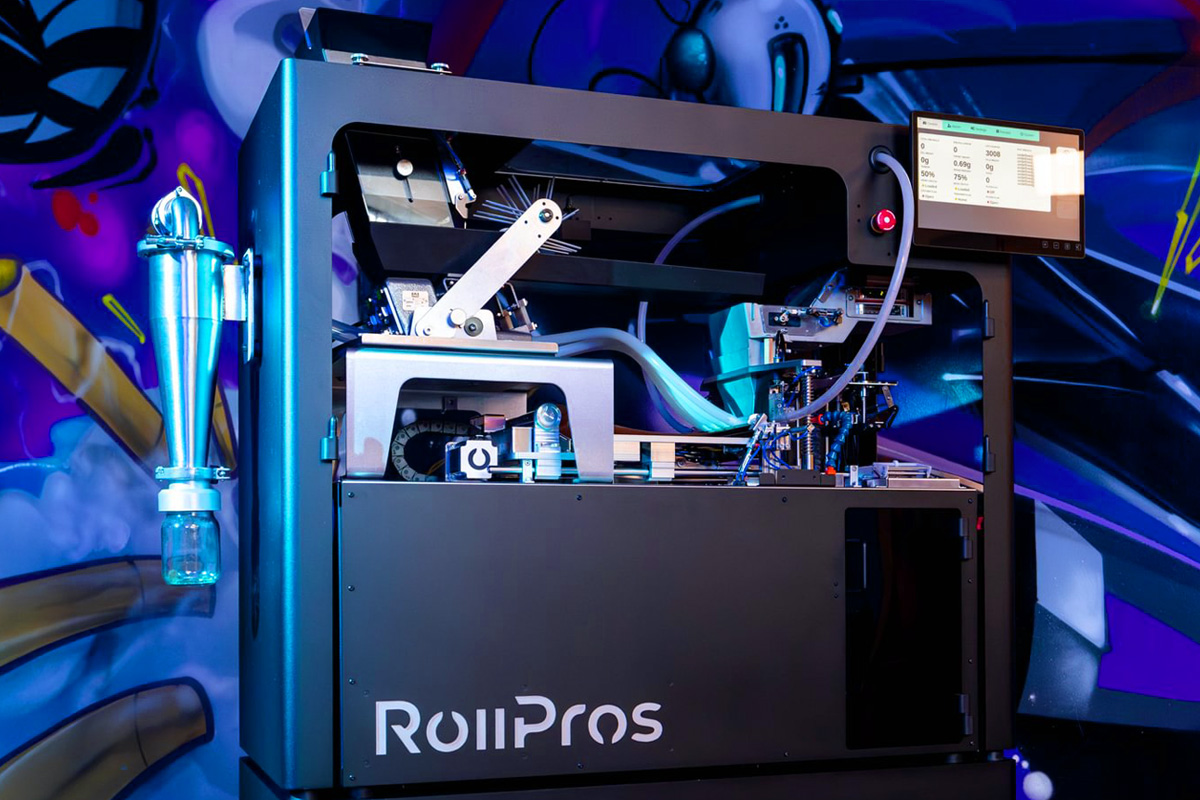

Blackbird produced joints SHOW UP

Oregon’s data tells a clear story: Blackbird-produced joints don’t just compete, they lead. Four of the top 20 pre-roll SKUs in the state are made on a Blackbird, including both the #2 and #3 ranked products overall. That kind of consistency at the top of the charts is no accident. It’s proof of what happens when great flower meets precision automation.

In the top 10 non-infused multipacks that are NOT produced using a Blackbird, the average SKU sells for an equalized price of $2.54 per gram. The two Blackbird-produced SKUs in that format outperform that benchmark by a wide margin.

Even more telling, Blackbird-produced products make up only 20% of the top 10 SKUs by revenue, yet they account for 29% of the total revenue in that group. Nearly one-third of all dollars generated by Oregon’s ten best-selling non-infused multipacks are coming from just two Blackbird operators.

This is what we mean when we say the Blackbird helps brands build value, not just volume. In a market where margins are tight and quality drives loyalty, our operators are proving that better joints don’t just roll better—they sell better.

We talk with Khalil Niemeyer Owner of Kaprikorn

In a market as competitive as Oregon, standing out takes more than just good flower — it takes consistency, quality, and a deep understanding of what consumers actually want. Few embody that better than Kahlil Niemeyer, owner of Kaprikorn Farms. Known for producing premium indoor flower and top-performing pre-rolls, Kaprikorn has quietly built one of the most respected operations in the state. Their 10-pack joints are among Oregon’s best sellers, priced nearly 35% higher per gram than the market average, proving that smokers will pay for a better experience. Kahlil’s approach to scaling, and staying true to craft values while embracing smart automation, has helped Kaprikorn quickly carve out a leadership position in Oregon’s evolving pre-roll category. We caught up with him to talk about the state of the market, how Kaprikorn found its niche, and what’s next for one of the region’s standout producers.

How would you describe the oregon market to other operators?

Oregon’s market is incredibly mature and competitive. Retail started back in 2016 with unlimited licenses, and even now there are more than a thousand active producer licenses serving just four million people. That kind of saturation drives prices down and forces everyone to be sharper on efficiency and consistency. Labor costs are high, margins are tight, and shelf space is hard to earn. To survive, you need to understand your strengths and double down on them. For us, that’s quality flower and well-run systems. Automation and smart scaling have become essential, it’s the only way to stay viable while maintaining quality.

– KAHLIL NIEMEYER, Owner of Kaprikorn

To read the full Q&A download the PDF

Conclusion

Oregon’s pre-roll market continues to prove why it is one of the toughest and most revealing in the country. While overall cannabis sales have remained flat, the pre-roll category keeps growing, showing steady progress in a market defined by thin margins and intense competition.

The brands winning here are not relying on hype or scale. They are building loyalty through quality, efficiency, and consistency. Local operators such as Kaprikorn, and Benson Arbor are proving that Oregon rewards execution, not just name recognition. With automation helping bridge the gap between craft and scale, Blackbird-produced joints stand out for both their performance and their ability to command higher prices.

For anyone operating in the pre-roll category, Oregon will continue to be a very interesting and educational market to watch. It demands intention, rewards authenticity, and demonstrates that the combination of great flower and smart automation is not just the future of pre-rolls, it is already here.

Download PDF

Grab a printable copy of this report by filling out the form below: